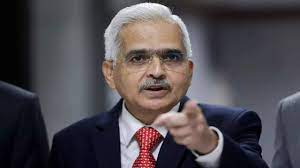

At the 33rd conference of state finance secretaries, which took place on Thursday in Mumbai, Governor Shaktikanta Das of the Reserve Bank of India emphasized how important it is for state governments to maintain a sustainable level of debt and assessed their market borrowings.

“He emphasized on the need for the states to focus on fiscal consolidation, improving quality of expenditure and other issues related to the fiscal health of states such as contingent liabilities/guarantees, etc.,” the RBI said in a release following the meeting. “He emphasized on the need for the states to focus on fiscal consolidation, improving quality of expenditure and other issues related to the fiscal health of states.”

During the meeting, in addition to discussing borrowing from the market, participants discussed the administration of the consolidated sinking fund and the guarantee redemption fund, as well as concerns concerning state government guarantees and the RBI’s provision of short-term financial accommodation to states.

This evaluation is taking place at a time when the amount of money that state governments have borrowed has increased by more than 60,000 crores compared to the previous year.

Scheduled Appointment With the ED The Reserve Bank of India has announced the appointment of P. Vasudevan to the position of executive director, beginning July 3. At the Reserve Bank of India (RBI), he will be responsible for managing the departments of currency management, corporate strategy, the budget, and enforcement. As CGM The department of payment and settlement systems was under Vasudevan’s supervision during his tenure as head of the department. He is a member of the Institute of Cost Accountants of India in addition to having a bachelor’s degree in commerce from a recognized university.

Read Also : Union Mutual Fund anticipates a 50% increase in assets under management, to Rs 15,000 cr by March.