Introduction:

The terms notional value and market value might be perplexing. These concepts are closely related and are frequently used interchangeably by both rookie and experienced investors. However, it is critical to recognize that notional and market values are distinct notions. They serve fundamentally distinct functions in the stock and derivative markets. Understanding their distinctions and importance will allow you to use them more effectively. Continue reading to learn more.

What is the notional value?

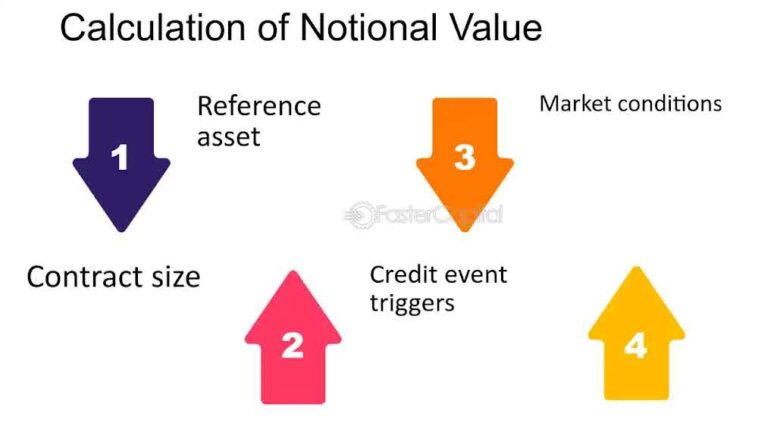

The notional value is a statistic used to describe an asset’s overall worth. It covers both the money invested and the asset’s market value. It is the difference between the market price paid for an asset and the total investment connected with the transaction. The notional value is computed by multiplying the contract’s units by the current spot price.

When investing in futures, equities, Exchange-Traded Funds (ETFs), foreign currency exchange, total return swaps, interest rate swaps, and foreign currency derivatives, the notional value can be used. It is an important statistic for analyzing and managing risk while examining various financial instruments.

What is the market value?

Market value is the agreed-upon price of a security in the market. It is decided between buyers and sellers and is calculated based on the demand and supply of the security. It is a comprehensive measure that represents the current sentiments and desires of all market participants. A security’s market value can be a good measure of investor opinion toward a company’s business prospects.

Here’s an example to help you understand how these two values work:

Suppose you decide to invest in an XYZ Index futures contract. This particular futures contract consists of 200 units, each priced at Rs. 4000 in the market. Therefore, the market value of a single unit is Rs. 4000. Now, if we calculate the notional value of the XYZ Index futures contract, it would be Rs. 4000 multiplied by 200 units, resulting in a notional value of Rs. 8,00,000.

So, in this scenario:

- Market value per unit = Rs. 4000

- Number of units per contract = 200

- Notional value = Rs. 4000 x 200 = Rs. 8,00,000

Differences between the notional and market value of a security

Here are some differences between notional and market value to help you understand their distinctions in detail:

- The market value represents a derivative contract’s underlying worth in relation to its market value. It is determined based on demand and supply and serves as a reference point for the total value of the contract. The notional value, on the other hand, represents the current market price for a security or financial instrument. It indicates the pricing agreement reached by buyers and sellers.

- The market value is determined by the price of a single security unit. It is the market price for obtaining this unit. In contrast, the notional value includes the total worth of a financial asset. It provides a comprehensive perspective of the security’s complete worth based on contract terms.

- The market value is the actual amount paid in the market for a given security. It reflects the market’s current supply and demand dynamics. The notional value, on the other hand, represents the overall value of the financial security’s position. It provides more information about an asset’s total value.

-

Also read :- Difference Between Shooting Star And Inverted Hammer Candlestick Patterns

- The market value represents the current market view of the security’s value. It is, nevertheless, prone to variations that are influenced by market conditions. The notional value simply emphasizes a financial security’s overall position. It serves as a reference point for comprehending the derivative contract’s greater financial commitment.

To sum it up

While the market value represents the immediate cost of purchasing a security, the notional value provides a more comprehensive view of the whole value of a financial asset’s position. Based on your financial aspirations, goals, and risk tolerance, both values can help you determine if the item is a viable investment.