Introduction:

Stock market investment necessitates rigorous study and well-considered decisions, especially for those participating in intraday and short-term trading. It demands a careful examination of numerous technical charts as well as a rigorous examination of specific stocks. These activities increase the possibility of profit while reducing the risks associated with volatile markets.

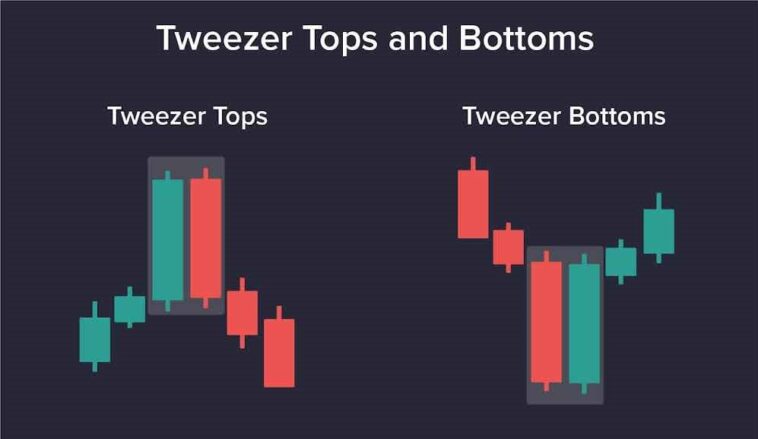

Advanced candlestick patterns, which are also used in many automated trading platforms, are used by seasoned investors and traders. The tweezer top and bottom pattern, which suggests the likelihood of a slight trend reversal, is one such candlestick pattern.

This article will teach you the meaning, characteristics, and significance of the tweezer top and bottom candlestick pattern. Continue revising

ading.

What are candlestick patterns?

You must first comprehend candlestick patterns in order to learn about tweezer tops and bottoms. Candlesticks are visual representations of a stock’s price changes over time. Each candlestick is made up of a body, a wick, and a color. The body depicts the opening and closing prices, while the wicks reflect the high and low values for the specified time period. The color indicates whether the stock price has increased or decreased.

When many candlesticks are lined up one after the other in a precise sequence, a candlestick pattern is generated. As an investor, you can use various candlestick patterns to bet on short-term stock price movements and make informed trading decisions. You can combine candlestick patterns with other technical indicators to improve the accuracy of your judgment.

What are tweezer tops and bottoms?

The tweezer top and bottom candlestick patterns develop when two consecutive candlesticks with comparable highs or lows appear. Let’s break down each of these two patterns for a better understanding:

- Tweezer top candlestick pattern

A tweezer top is a bearish reversal candlestick pattern that forms at the end of an upswing. The first candlestick in this pattern is bullish (green or white), signaling that a stock is under pressure to buy. The second candlestick is bearish (red or black in color) and the same height as the first, forming a horizontal line.

The emergence of this pattern suggests a shift in investor attitude. It indicates that buyers are losing momentum and sellers are attempting to take control, indicating a trend flip from bullish to bearish. When you notice a tweezer top, you can commence a short position and exit your long position.

- Tweezer bottom candlestick pattern

A tweezer bottom candlestick pattern comes at the end of a decline. The first candlestick in this pattern is bearish (red or black), indicating that a stock is under selling pressure. The second candlestick is bullish (green or white in color), with the same low as the first.

The appearance of the tweezer bottom candlestick pattern indicates that the sellers are losing control and the purchasers are regaining power. When you notice a tweezer bottom, you might start a long position or exit a short position. When starting a long trade, utilize the low of the second candlestick as your stop loss.

Identifying tweezer tops and bottoms

Below are the characteristics that can help you identify the tweezer top candlestick pattern:

- The preceding trend must be upward.

- During the first time frame, a bullish candlestick must form.

- It must be followed by a bearish candlestick of comparable height.

Below are the characteristics that can help you identify the tweezer bottom candlestick pattern:

- The preceding trend must be negative.

- During the first time frame, a bearish candlestick must form.

- A bullish candlestick with a similar low must follow.

In conclusion

Tweezer tops and bottoms can be used by stock market traders to make informed trading decisions, often to bet on trend reversals. At the end of an uptrend, a tweezer top forms. It’s a good time to sell or enter a short position. A tweezer bottom, on the other hand, comes toward the end of a decline. It could be a buy or long indication. A stop-loss can be placed immediately above or below a tweezer’s top or bottom.

While tweezer patterns can be powerful indications, you should also use other technical indicators and analysis tools, such as moving averages, trendlines, and other candlestick patterns, to back up your trading selections.

With Motilal Oswal, you may open a free Demat account and start trading stocks from the comfort of your own home.