Those who are new to the stock market may have heard of a significant number of companies preparing to launch an initial public offering (IPO). However, have you ever pondered the meaning of IPO? Should you possess such knowledge, this article shall assist in elucidating the notion and its ramifications for both the investor and the company. Thus, without additional preamble, we shall commence.

What Does IPO Mean?

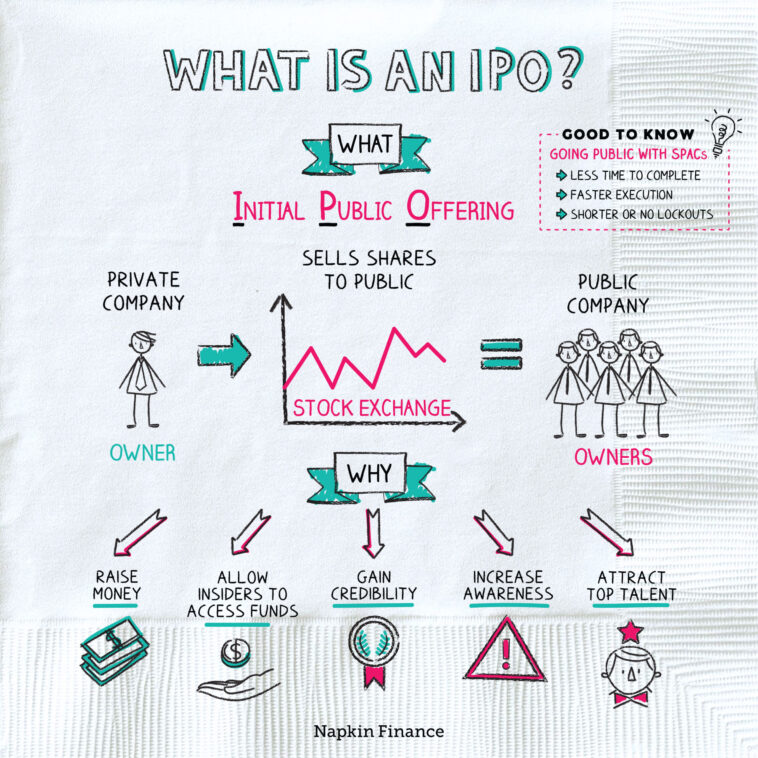

An IPO, which stands for Initial Public Offering, is the procedure through which a company sells its shares to the public for the first time. By purchasing a company’s shares, the general public becomes a shareholder in the entity and is entitled to its profits.

An initial public offering (IPO) benefits both the investor and the company. The corporation raises funds by selling its shares to the general public, which it can then use to pursue its corporate objectives.

How Does an IPO work?

Let’s look at how IPOs work now that you know what they are.

Assume XYZ Limited requires around Rs. 5 crores to expand its operations. It now intends to raise this sum by selling shares to the general public. The company completes the entire IPO process and successfully sells its shares.

By purchasing the company’s shares, the investors become shareholders and are entitled to a portion of the entity’s profits. And the Rs. 5 crores that the company obtained from the sale of its shares to the public can be used to fund expansion or to pay off debt.

Why Do Companies Opt to Go for an IPO?

Apart from being able to raise funds for its operations, there are many reasons why a company might want to issue its shares to the public. Here’s a quick look at a few of them.

1. It gives existing investors an exit

An Initial Public Offering (IPO) typically consists of two components: a new issue of shares from the firm and an offer for sale (OFS) from its promoters. Early investors, including the company’s promoters, can sell a portion of their interest to the public via this OFS component. The funds obtained from an OFS are distributed to the persons and entities selling the interest rather than to the corporation. Early investors might realize the rewards on their investment by selling their shares in a forthcoming IPO in 2023.

2. It makes the company more credible

A firm that is listed on a stock exchange following a successful IPO has greater visibility and credibility than a company that has not. This makes it easier for the organization to obtain loans and other credit facilities.

Conclusion

I hope you now understand what an IPO is and how it can benefit a firm. However, if you want to invest in a forthcoming IPO, you must first establish an active Demat account in your name. You can open a Demat account in a matter of minutes by visiting the Paytm online website.