Are returns earned from my bond investment taxable?

Indeed, there are taxes applicable to bond investments in India.

The investor’s regular income tax rate applies to interest income from government bonds; no TDS is deducted.

Equally taxed at the standard rate is interest income from corporate bonds. At the applicable rates, the issuing company deducts TDS as well.

In accordance with the holding period, capital gains from the sale of bonds are taxed differentially. Short-term capital gains are incurred on sales occurring within 36 months, subject to taxation at the regular rate, plus any applicable cess and surcharge. It is classified as long-term capital gains and subject to a reduced tax rate if retained for a duration exceeding 36 months.

However, depending on variables such as residency status, income tax classification, and bond terms, the tax treatment of particular bond investments by individuals may differ. For personalized advice, it is prudent to consult with a tax advisor.

How to determine your DP ID and Client ID?

To find your DP ID and Client ID, follow these steps:

- Contact your Depository Participant: The DP is the entity through which you have opened your demat account. Reach out to your DP’s customer service or support team.

- Provide necessary details: Provide the required information, such as your name, account number, and any other identification details requested by the DP.

- Verification: The DP will verify your details to ensure your ownership of the demat account. This may involve sharing personal identification documents or answering security questions.

- DP ID: Once the verification is complete, the DP will provide you with your unique DP ID. This is a unique identification number assigned to the DP with whom you hold your demat account.

- Client ID: After receiving your DP ID, the DP will also provide you with your unique Client ID. This identifier distinguishes you as an individual client within the DP’s records.

How will I receive the interest payment?

The interest payment will be deposited into the bank account of the bondholder that is linked to their Demat account in accordance with the predetermined schedule. The interest accrued on the bond will be deposited directly into the bondholder’s designated bank account via this payment. The Demat account facilitates this transaction by acting as an intermediary and conservatory for securities in an electronic format, functioning as a digital repository.

The synchronization of the bondholder’s bank account and Demat account facilitates a streamlined and more expedient interest payment process. The punctual disbursement of interest payments is guaranteed by the predetermined schedule, enabling the bondholder to obtain the accumulated interest at consistent intervals. In general, this configuration streamlines the payment procedure and affords the bondholder a seamless experience, given that the interest payment is systematically deposited into the bank account that is associated with the Demat account.

Once a Bond matures, how do I get my money back?

On the date of maturity, the funds invested in bonds and debentures are automatically deposited into the investor’s bank account. By means of this automated procedure, the investor is guaranteed prompt and trouble-free receipt of their invested capital.

Fixed-income securities, including bonds and debentures, provide investors with a pre-established interest rate. The principal amount is remitted to the investor on or before the maturity date specified. The investment amount is remitted into the investor’s bank account in a streamlined and troubleshootable manner, without requiring any manual intervention. By means of this system, the investor is guaranteed the prompt and trouble-free receipt of their invested capital.

Notably, in order to guarantee the success of the remittance procedure, the investor is required to furnish precise bank account information. In general, investors are able to obtain their investment amount in a timely and effective manner through the automated remittance procedure for bonds and debentures.

When will I receive bond units in my Demat?

The bond units will be expeditiously deposited into your Demat account on the N+1 day, which is the trading day following the confirmation of your order. The bond units will be effectively transferred and credited to your Demat account within a single business day subsequent to the confirmation of your transaction.

The T+1 day may fluctuate in accordance with the exchange and settlement cycle, which are both significant factors to consider. By adhering to this procedure, the purchased bond units are quickly and effectively allocated. Your ownership of the bond units is immediately transferred upon compliance with the T+1 day timeline for the transaction to be executed.

Your dematerialized securities, including bond units, are securely stored in a digital repository within your Demat account. By facilitating the post-order procedure, this arrangement ensures that your bond units are promptly deposited into your Demat account on the subsequent trading day and permits effortless monitoring and transfer.

Where will I receive my interest payment?

The interest payouts from Bonds are credited to the bank account of the bondholder that is linked to their Demat account. This automated process ensures that the bondholder receives their interest payment without any delay or inconvenience.

A Demat account is an electronic account that holds securities, such as stocks, bonds, and mutual funds in an electronic form. It eliminates the need for physical certificates and provides a secure and convenient way to hold and trade securities. By linking their bank account to their Demat account, bondholders can receive their interest payments directly without any manual intervention. This system ensures that the interest payment process is streamlined and efficient, providing a hassle-free experience for bondholders.

It is important to note that the bondholder must ensure that their bank account details are accurate and up-to-date to ensure that the interest payment process is successful. The automated interest payout process for Bonds provides a convenient and efficient way for bondholders to receive their interest payments.

Why Do I need to pay accrued Interest?

Accrued interest is a real cost that can be incurred when trading, especially in the bond market. Interest on a bond that has accumulated since the last interest payment date is called “accrual.”

Bondholders are promised periodic interest payments equal to the coupon rate. If you acquire a bond in the interim between interest payments, the seller has had possession of the bond for a portion of the interest period. Therefore, he is entitled to interest payments for that period.

Accrued interest payment ensures all parties are treated fairly. It takes into account the time value of money by paying the seller the interest they would have received if they had held onto the bond until the next interest payment date.

Accrued interest payments in trading protect both parties by distributing interest proportionate to their respective bond holding periods.

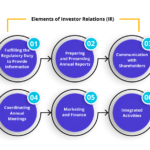

Also read :- Everything You Need to Know About Investor Relations

Why is the yield different from Coupon?

When discussing bonds, the terms coupon rate and yield are two separate ideas.

An investment bond’s coupon rate is the benchmark by which interest payments are calculated on a periodic basis. When the price of a bond and other market considerations are taken into account, yield shows how much money an investor may expect to make. Several factors can cause a bond’s yield to be different from the coupon rate. Any time the market price of a bond is higher than its face value, the yield falls below the coupon rate, and vice versa. The yield rises as interest rates go up and falls when they go down, hence interest rate fluctuations have an effect on the yield.

Bond yields are sensitive to a number of factors, including credit risk and duration. As a result of the time value of money, bond yields for longer maturities are typically greater than those for maturities of shorter durations. Bonds with a higher credit risk have higher yields to compensate investors for the higher probability of default.