Introduction

Have you ever wondered how to invest in commodities such as gold, silver, oil, or wheat without physically purchasing and storing them? Alternatively, how can you diversify your portfolio by gaining exposure to other sectors and areas of the world? If you answered yes, you may be interested in learning more about exchange-traded commodities (ETCs).

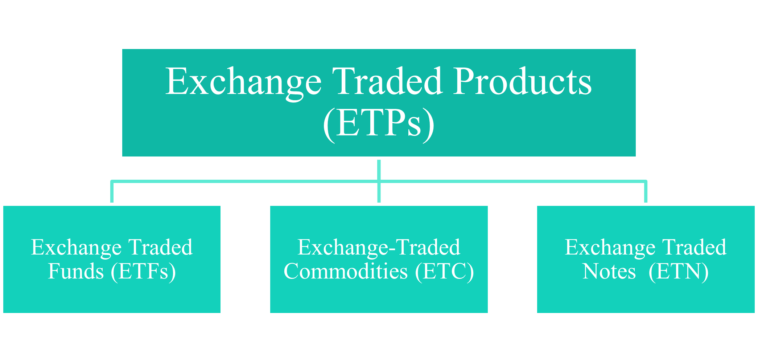

ETCs are financial products that reflect the performance of a single commodity or a group of commodities. These products, like shares, are regularly traded on stock exchanges, giving a practical and cost-effective way to participate in commodities markets.

What are the types of ETCs?

There are two main types of ETCs: physical ETCs and synthetic ETCs.

- Physical ETCs: They monitor the physical commodity by which they are secured. A physical gold ETC, for instance, is comprised of gold bars vaulted securely, and its value corresponds to the current price of gold. Additionally, they are known as exchange-traded notes (ETNs).

- Synthetic ETCs: Instead of being backed by a tangible commodity, they rely on derivatives contracts such as futures or swaps. A synthetic oil ETC, for example, does not own actual oil barrels; rather, it enters into a contract with a counterparty to settle the difference between present and future oil prices. Exchange-traded commodities (ETCs) and exchange-traded certificates (ETCs) are other names for them.

Benefits of Exchange Traded Commodities

ETCs offer several benefits to investors who want to gain exposure to the commodity markets. Some of these benefits are:

- Diversification: They enable you to diversify your portfolio across asset classes, industries, and regions. Commodities typically have a low or negative correlation with other securities such as equities and bonds, implying that they can reduce the portfolio’s overall risk and volatility.

- Liquidity: They can be traded on D-street much like stocks. During market hours, you can easily and quickly invest and redeem them. You are not required to find buyers or sellers for your commodities, nor are you required to pay excessive commissions or fees.

- Transparency: They have obvious and basic structures, and their pricing are determined by supply and demand market factors. You can quickly obtain information about the underlying commodity, the ETC supplier, the fees, and the ETC’s performance.

- Cost-effectiveness: ETCs eliminate the need for you to purchase and store actual commodities, which may be costly and time-consuming. You also avoid dealing with difficulties such as commodity quality, delivery, shipping, insurance, and taxation. ETCs also offer cheap management fees and transaction expenses when compared to other types of commodities investments.

What are the risks of ETCs?

ETCs also have some risks that you, as an investor, must be aware of before investing in them. Some of these risks are:

- Tracking error: ETCs may not completely match the performance of the underlying commodity because to a variety of factors such as fees, expenditures, rebalancing, and liquidity. You may notice a mismatch between the ETC returns and the commodity’s actual returns.

- Counterparty risk: To track the performance of the commodities, synthetic ETCs rely on derivatives transactions with counterparties. You may lose some or all of your investment if the counterparty fails to meet its obligations or declares bankruptcy.

- Regulatory risk: They are subject to the rules and regulations of the stock exchanges and the jurisdictions where they are listed and traded. These rules and regulations may change occasionally, affecting the availability, liquidity, taxation, or performance of the ETCs.

Also read :- Seven Easy Ways To Make Money In Stocks

Conclusion

ETCs are an appealing choice for investors looking to get exposure to commodity markets. They provide a number of advantages, including diversification, liquidity, transparency, and cost-effectiveness. They do, however, carry some risks, such as market risk, tracking inaccuracy, counterparty risk, and regulatory risk. As a result, before investing in them, conduct thorough study and analysis. Understand your objectives, risk tolerance, and time horizon.

ETCs can be a great complement to a well-balanced portfolio if utilized wisely and conservatively.