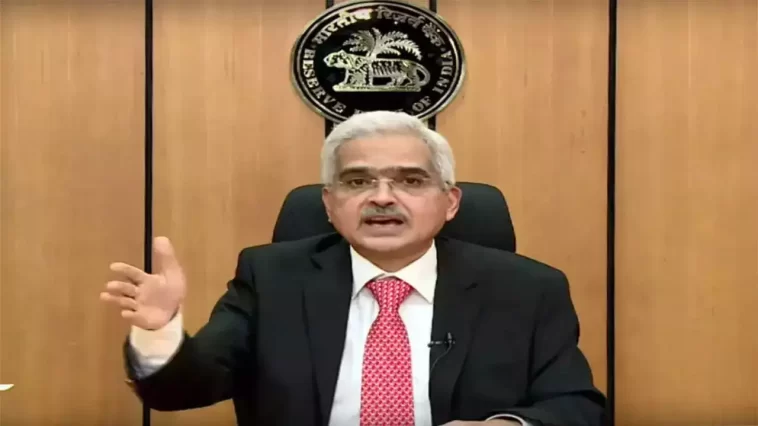

The Reserve Bank issued instructions on Friday allowing G20 visitors to India to use the mobile-based Unified Payments Interface (UPI) to make payments.

UPI is a system that combines multiple bank accounts into a single mobile application, combining multiple banking features, seamless fund routing, and merchant payments on a unified platform.

Wednesday, the Reserve Bank of India (RBI) issued a statement allowing UPI access to foreign nationals and non-resident Indians (NRIs) visiting India.

Initially, it was stated that the facility would be extended to G20 travellers at select international airports for their merchant payments (P2M) while in the country. Later, it will be implemented at all country entry points.

“Banks/ Non-banks permitted to issue PPIs may issue INR-denominated, full-KYC PPIs to foreign nationals/NRIs visiting India”

Such prepaid payment instruments (PPIs) may also be issued in co-branding arrangements with entities authorised under FEMA to deal in foreign exchange.

“The PPIs can be issued in the form of wallets that are linked to the UPI and can only be used for merchant payments (P2M),” the document continued.

The directives became effective immediately.

It also stated that PPIs would be issued only after a physical verification of the customer’s passport and visa at the point of issuance.

“Loading / Reloading of such PPIs shall be subject to receipt of foreign exchange in cash or via any payment instrument,” the RBI stated.

These PPIs may be cashed in foreign currency or transferred “back to source” if they contain unused funds.

The G20, also known as the Group of 20, is an intergovernmental forum comprised of the world’s leading developed and developing economies.

It includes Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the United Kingdom, the United States, and the European Union (EU).

Also read this:IIP Index :Index of Industrial Production growth falls to 4.3% in December, from 7.3% in November, according to government data.

In January, UPI payment transactions increased by 1.3% month-over-month to nearly 13 lakh crore rupees.