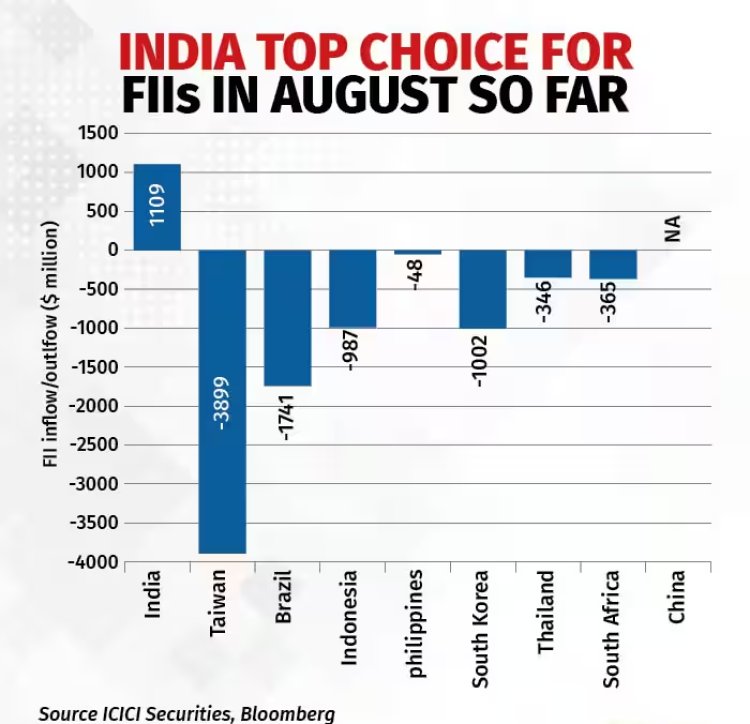

In August, India attracted the highest level of foreign investment compared to emerging and developed markets, despite the fact that key stock indices had declined eight times in the previous fourteen trading sessions.

So far in August, foreign investors have invested $1.11 billion in domestic equities while withdrawing funds from other markets. Foreign institutional investors sold the most in Taiwan ($3.9 billion), followed by Brazil ($1.74 billion), Indonesia ($1 billion), South Korea ($1 billion), Thailand ($350 million), and South Africa ($350 million).

According to SEBI data, FIIs have purchased approximately $16 billion in local equities so far this year, and $19 billion since April 1.

Amit Pabri, a senior analyst at CR Forex, stated that FIIs’ investment patterns have demonstrated a positive trend. Their allocation is 20% of the average for the last three months. The considerable disparity between FII flows and the movements of the Nifty index can be attributed to global unpredictability.

Major global credit rating agencies recently downgraded the United States and its finance sector. Concurrently, concerns about China’s real estate sector, primarily Country Garden, prompted hedge funds to sell off their holdings. Regulatory actions stabilised the situation, but Evergrande’s bankruptcy filing intensified the pressure on Chinese equities.

According to analysts, foreign investors are consequently transferring their investments to the promising Indian market.

Domestic challenges

Meanwhile, domestic equities confront a number of obstacles. Uncertainty on a global scale, rising domestic inflation, and profit booking have cast shadows. Analysts claim that as a result, foreign investors are diversifying into India for stability amid global complexities.

In contrast to China, Ajay Bodke, an independent market analyst, stated that India’s development prospects remain positive due to a resilient investment and real estate cycle supported by low levels of non-performing assets. This positive trajectory is supported by India Inc.’s consistent earnings performance, expectations of a continued hiatus in interest rate increases by the Reserve Bank of India, and the stability of the rupee, all of which contribute to positive FII buying despite declines in local equities.

India is anticipated to experience robust development in the second quarter of 2023, according to brokerages. The RBI is anticipated to maintain its current stance throughout the entire fiscal year, which is shared by a majority of those surveyed. The GDP data for the April-June quarter will be released on August 31. In the second quarter of 2023, GDP growth may have increased to 8 percent, as predicted by the RBI.

After a robust rally in August, the Indian markets have entered a corrective phase since then. Recent gains have positioned markets for consolidation, according to analysts, so a significant decline is unlikely.

According to Kotak Institutional Equities, a solid macroeconomic foundation, advancements in consumption sectors, and a favourable perception of India serve as market downturn safeguards. However, it is anticipated that elevated valuations across sectors will limit further upside potential.

The Sensex and the Nifty, India’s two most important stock market indices, have both declined by nearly 2.4 percent so far in August, the first monthly decline after five consecutive months of gains. The decrease was the most significant since December 2022.

Also Read : 5 Must read books on investment, trading, and stock market

In addition, the BSE MidCap index declined 0.1% while the BSE SmallCap index increased nearly 1%. Since March 28th, the Sensex and the Nifty have each gained approximately 13%, while the midcap and smallcap indices have gained approximately 30% and 35%, respectively.

Foreign portfolio investors maintained their purchases of high-risk equities in July 2023, primarily in cyclical and capital-intensive sectors (financials, industrials, discretionary consumption, and energy), according to data from ICICI Securities.

In the meantime, the recent increase in US bond yields has prompted fears of an acceleration in FPI outflows from Indian markets. However, ICICI Securities believes that these worries may not have a reliable foundation. “The recent increase in US yields from 3.75% to 4.3% was precipitated by Fitch’s downgrade of the country’s credit rating and is placing pressure on FPI flows into India. Nevertheless, given the inflation outlook, the yield on US 10-year bonds is likely near its upper bound. This should alleviate concerns regarding FPI outflows, while structural domestic equity flows in India remain positive, as evidenced by record-high SIP flows, according to a report from ICICI Securities.

Disclaimer: The opinions and investment advice expressed by Moneypoise’s experts are their own and do not reflect those of the website or its administration. Prior to making investment decisions, Moneypoise advises users to consult with certified experts.