Small and mid-cap stocks have had a terrific year, and experts are focusing on this segment of the country’s $3.7 trillion market as they choose possible winners for Diwali, which takes place this Sunday.

The day celebrates the beginning of the new Hindu year, and stock exchanges have a one-hour special session during which investors and traders make ceremonial purchases. This season’s picks include property developers as well as significant cement, cable, and chemical makers.

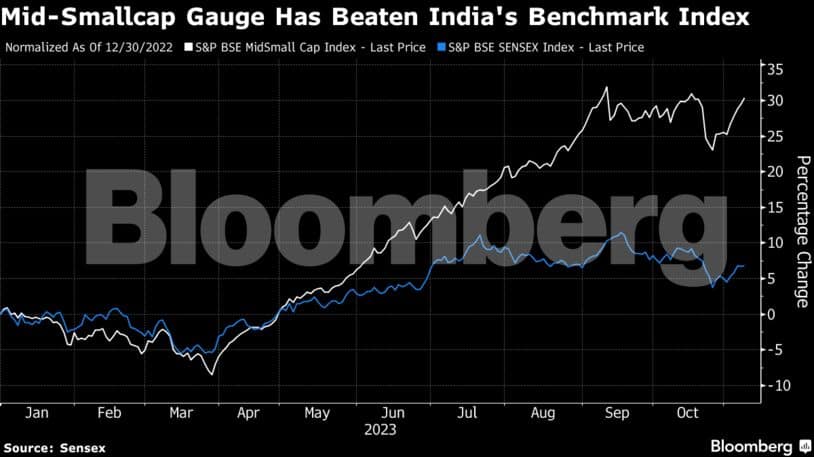

Small- and mid-cap equities have outperformed their larger rivals this year, owing to wagers that domestic-facing names will gain more from the country’s fast-growing economy. Since January 1, the S&P BSE MidSmall Cap Index has increased by 30%, more than four times the gain of the benchmark S&P BSE Sensex Index.

Analysts have chosen the following as their best festival picks:

SBI Securities

Polycab India Ltd.

-

- In recent years, the cable and wire manufacturer has increased its foothold in the electrical goods market and secured contracts for rural electrification initiatives.

-

- Its electrical goods division accounts for around 15% of total revenue and is projected to break even by 2025.

-

- Polycab expects to bring in 200 billion rupees by March 2025, a figure that represents growth of almost 40% from fiscal year 2023 levels.

Kolte-Patil Developers Ltd.

-

- The real estate company’s stock price has increased by almost 70% this year, which is significantly more than the 50% increase in the BSE Ltd. sector gauge. SBI analysts believe the company will prosper as a result of its plan to enter new markets, particularly through residential rehabilitation projects in Mumbai.

-

- The company’s principal initiatives remain focused on the western Indian city of Pune, where they plan to expand into the affordable housing market.In HDFC Securities We Trust

Gujarat Alkalies and Chemicals Ltd.

-

- Benefits from the caustic soda and chlorine products manufacturer’s joint venture with National Aluminum, as well as the rest of its capex, will begin to trickle in over the next few quarters.

-

- Companies under Gujarat state administration must adhere to the state’s regulations for returning capital, which provide for dividends of at least 5% of net worth or 30% of net income.

Kalpataru Projects International Ltd.

-

- The company’s orders are greater than three times its sales from the previous year, and it has a presence in the power transmission, oil & gas, and civil infrastructure industries.

-

- There will be a need for new transmission lines as businesses embrace renewable energy, and Kalpataru has indicated a robust bidding pipeline of around 1 trillion rupees from which to draw.

Nirmal Bang Institutional Equities

Cipla Ltd.

- Cipla’s sales from the North American market is only about 25% of total revenue, a lesser share than its competitors. Since there is less rivalry in the respiratory market, the generic manufacturer intends to focus on that area.

CCL Products India Ltd.

Companies like CCL, the largest coffee exporter in the country, stand to gain from Europe’s current economic crisis because of the continent’s anticipated increase in coffee imports from countries like India and Vietnam, where CCL operates plants.

While CCL’s significant emphasis on R&D and technology is certainly a differentiating advantage, the company’s capacity to produce several mixes in higher volume and its broad sourcing capabilities are also key differentiators.

Kotak Securities

Dalmia Bharat Ltd.

The cement producer can expand, both organically and inorganically, because of its healthy financial position and low borrowing. Profit margins will improve in the next quarters thanks to the company’s strong presence in the eastern and southern regions of India, where prices have recently increased dramatically.

Canara Bank

The lender’s bad debt ratio has dropped to a multi-year low, and yet the stock has only gained 16% this year, lagging behind competitors like Indian Bank and Bank of Maharashtra, which have both gained more than 40%.

Even though it still trades at a discount to rivals, the bank has experienced a decline in credit costs in recent quarters, which has helped it improve its return-on-equity ratio.