Samhi Hotels raised Rs 130 crore through the sale of equity shares from Blue Chandra Pte Ltd, a subsidiary of Equity International Fund V. Each share sold for Rs 126.

The Singaporean investment group Blue Chandra had been the largest shareholder in the branded hotel ownership and asset management platform prior to this equity sale.

Samhi Hotels disclosed in a press release dated September 9 that Blue Chandra, one of the selling shareholders in the company’s IPO, has transferred 1,03,17,460 equity shares at a price of Rs 126 per share. This represents 8.4 percent of the pre-offer paid-up equity (sale shares).

On September 6, Blue Chandra sold 23.8 million shares (1.94 percent pre-offer stake) to Madhuri Madhusudan Kela, wife of ace investor Madhusudan Kela, for Rs 30 crore, and 55.55 million shares (4.52% pre-offer stake) to Nuvama Crossover Opportunities Fund for Rs 70 crore.

On September 8, TIMF Holdings, a venture capital firm based in San Francisco, purchased 23.8 lakh shares (1.94 percent pre-offer interest) in Samhi Hotels from Blue Chandra for Rs 30 crore.

Blue Chandra’s pre-offer paid-up equity share capital in privately held Samhi Hotels has decreased from 30.65 percent to 22.25 percent as a result of the sale. As a result, it has surpassed ACIC Mauritius as the company’s second-largest stakeholder (after ACIC Mauritius, which owns 30.51 percent).

“The shares being sold by Blue Chandra are not part of the equity shares that Blue Chandra intends to offer for sale in the OFS. Shares offered for sale “shall be subject to lock-in,” the business declared.

Subscriptions for the public issue of privately held Samhi Hotels will be open from September 14-18, as stated in the red herring prospectus (RHP) filing made on September 5. This is prior to the aforementioned stake sale by Blue Chandra.

Redmi Pad | MediaTek Helio G99 | 26.95cm (10.61 inch) 2K Resolution & 90Hz Refresh Rate Display

Lenovo Tab M10 HD (2nd Gen)|10.1 Inch (25.6 cm) |3 GB RAM, 32 GB ROM

Possible Offer Size

The company is issuing new shares valued at Rs. 1,200 crore, while three selling shareholders—Blue Chandra, Goldman Sachs Investments Holdings (Asia), and GTI Capital Alpha—are offering an additional 1.35 crore shares through an OFS.

Goldman Sachs Investments Holdings (Asia) currently owns 17.94% of the stock, followed by GTI Capital Alpha with 11.2% and Sarvara Investment Fund I with 6.68%.

Samhi Hotels, which is managed by experts, has not yet declared the price range, but if it is anywhere near the Rs 126 per share at which Blue Chandra sold its 8.4 percent interest, the entire issue size will be roughly Rs 1,370.1 crore.

The majority of the net proceeds from the fresh offering would go toward retiring the company’s 900 crore rupees in debt, while the rest will be used for working capital and other corporate objectives.

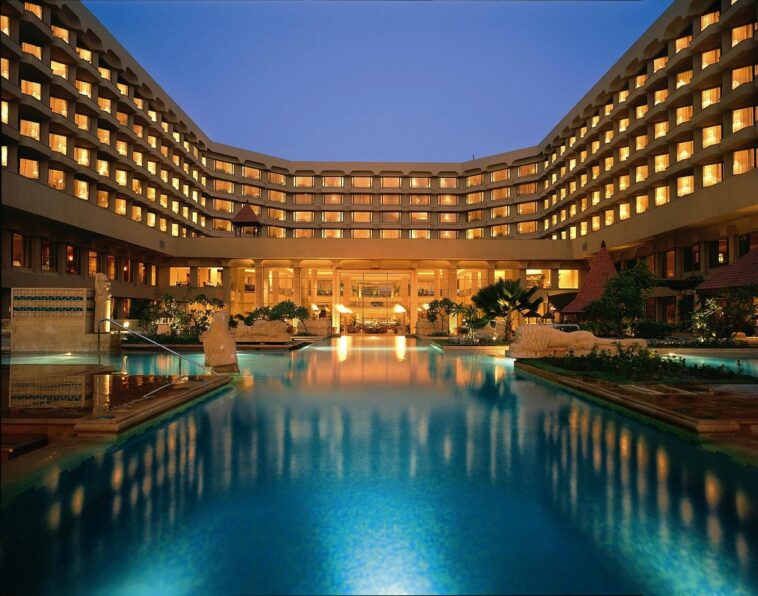

Samhi Hotels is a hotel owner and asset manager that focuses on purchasing or developing hotels, mainly those catering to business travelers, and then taking the necessary measures to modernize the properties and partner with well-known hotel brands. The company then uses its in-house, unique asset management tools and skills to further improve the property’s long-term financial and operational performance following the aforementioned one-time improvement.

It has taken just 12 years for the company to grow from its inception to its current portfolio of 25 hotels with 3,839 available rooms in 12 major urban centers for consumer spending in India. After acquiring ACIC on August 10, 2023, the total number of hotel rooms in its portfolio grew to 4,801.

Merchant banks JM Financial and Kotak Mahindra Capital Company are handling the offering.