Budget 2023 Revised Tax Slab

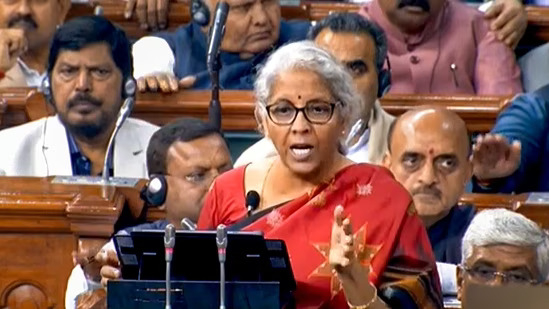

Prior to the general elections in 2019, the union finance minister Nirmala Sitharaman unveiled a Budget 2023 with a major spending plan that benefited the middle class by reworking tax brackets and investing significantly in the infrastructure and agricultural sectors.

Here is 10 points that you should know

1.In the final complete budget before the general elections next year, the government set seven priority areas. The areas are “inclusive development, reaching the last mile, infrastructure and investment, unleashing the potential, green growth, young power, and financial sector,” according to Union Finance Minister Nirmala Sitharaman.

2.The country’s economy has increased from 10th to 5th largest in the world, and per capita income has more than doubled, according to Ms. Sitharaman, who referred to it as the “first Budget of Amrit Kaal” — the 25-year era concluding in the centennial of India’s independence.

Also Read : | 5 Best Fully Automatic Washing Machines In India February 2023

3.According to the finance minister, capital investment spending will increase by 33% to Rs 10 lakh crore in the upcoming fiscal, or 3.3% of GDP in the 2023–2024 fiscal year.

4.The government has modified the income tax slabs in the new tax regime and said there will be no tax on income of up to Rs 7 lakh a year — up from Rs 5 lakh — in a major push for income tax relief ahead of an election year.

5.The minister declared an expenditure for the railroads of Rs 2.4 lakh crore, which is four times the budget from the previous year and the largest in almost a decade. She emphasised, “This is approximately nine times the outlay made in 2013-14,” when comparing it to the final year of the UPA run by the Congress.

6.The government plans to produce 5 MT of green hydrogen by 2030 with a goal of transitioning to green fuel, according to Ms. Sitharaman.

7.According to Ms. Sitharaman, the revised forecast for the current fiscal would maintain the fiscal deficit objective of 6.4%. It will be reduced to 5.9% for the upcoming fiscal year 2023-2024.

8.According to Ms. Sitharaman, the government will introduce a new dispute resolution programme under Vivad Se Vishwas-2 to make doing business easier and to resolve commercial problems. According to the minister, there would be a single point of contact for the reconciliation of IDs kept by various government agencies. All digital systems of the mentioned government institutions will use PAN as a common identity.

Budget 2023

9.Additionally, the government will launch new initiatives to support pharma research and innovation, establish a national digital library for kids and teenagers, and reform the way teachers are trained through a variety of programmes. The government will hire 38,800 instructors for the Ekalavya Model Residential Schools during the following three years.

10The Monthly Income Scheme and Senior Folks’ Saving Scheme investment caps have been lifted, which is a significant development for senior citizens.