The mood on Dalal Street remained subdued for the fourth consecutive week, with benchmark indices falling six-tenths of a percent for the week ending August 18 and bringing the cumulative loss from their record highs on July 20 to 3.4% on the Nifty50 and 3.94% on the Sensex.

Disappointing industrial production for June, a larger-than-anticipated increase in CPI inflation, fears of a likely additional rate hike by the Fed in light of strong retail sales data, currency depreciation versus the US dollar, rising US bond yields exerting pressure on FII flow, and a slowing Chinese economy all weighed on market sentiment.

According to experts, consolidation may persist with a negative bias in the coming week, with the focus on Powell’s speech, MPC policy minutes, FII sentiment, and global equity market activity.

The Nifty50 fell 118 points to 19,310 and the BSE Sensex fell 374 points to 64,949 as metal, banking & financial services, technology, oil & gas, and pharmaceutical equities weighed on the markets.

We expect domestic and global markets to remain under pressure next week due to Fed Chair Powell’s speech and the release of additional macroeconomic data, according to Siddhartha Khemka, chief of retail research at Motilal Oswal Financial Services.

However, he anticipates that the action will persist in the broader market alongside sector rotation.

Here are 10 key factors to watch out next week:

Jio Financial Services Listing

On August 21, the entity demerged from billionaire Mukesh Ambani-led Reliance, Jio Financial Services (formerly known as Reliance Strategic Investments), will be listed on the exchanges, drawing investor attention to the index heavyweight Reliance Industries (RIL).

Reliance’s financial services division is now worth Rs 261.85 per share following the spin-off last month.

On August 23, Jio Financial Services will join the MSCI Global Standard Index after already being included in the FTSE Indices.

MPC Meeting Minutes

In addition, on August 24, all attendees can find the minutes from the MPC’s August 10 meeting. After the Reserve Bank of India raised its Consumer Price Index inflation forecast for FY24 (to 5.4% from 5.1% earlier) due to the spike in food prices, experts believe the rate cut cycle will be pushed into FY25 instead of the fourth quarter of FY24. The Consumer Price Index increased by 7.44 percent in July, which was above market forecasts of a 4.87 percent increase.

Jackson Hole Symposium

The entire world will be listening to Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole economic policy conference on August 24-26. On August 25th, Powell will give a speech at an event organised by the Kansas City Fed. As the Fed remains firmly committed to bringing inflation back down to its 2% goal and continues to take a data-dependent approach in determining the extent to which additional policy firming may be appropriate going forward, Powell has already hinted at one more rate hike in upcoming policy meetings. Inflation in July was 3.2% according to the CPI and 4.7% according to the core CPI.

As a result, all eyes will be on his comments for any clear signals about when the current cycle of rate hikes might come to a stop and a new period of rate cuts might begin.

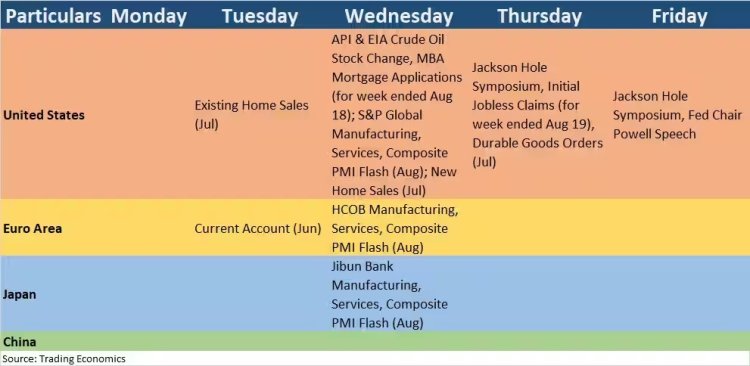

Here are key global economic data points to watch out next week:

The major reason for the FII outflow from emerging markets like India in August, after significant buying in the previous three months, is the rise in the US dollar index to 103.43 (from below the 100 mark in mid-July) and in US 10-year treasury yields to 4.25 percent (from 3.8 percent in mid-July). Despite the best efforts of DIIs to counteract the FII outflow, experts predict that the selling by FIIs will continue in the near future.

While foreign institutional investors (FIIs) net sold shares worth Rs 3,379 crore last week, bringing their monthly outflow to nearly Rs 11,000 crore in the cash segment, domestic institutional investors (DIIs) were able to more than make up for the FII outflow by buying shares worth Rs 3,892 crore last week, bringing their net buying for the month to around Rs 9,250 crore.

Indian Rupee

The Indian rupee’s performance will also be closely monitored by traders, as it recently set a record low of 83.42 versus the US dollar and a record closing low of 83.12 last week (on weekly basis) due to rising oil prices and the US dollar index. The rupee has been weak for four weeks running due to factors including profit taking in the stock market and FII outflow, and this trend is expected to continue in the days ahead.

We anticipate the Rupee will trade with a negative bias due to widespread fear in international markets and the Dollar’s general strength. Research analyst at Sharekhan by BNP Paribas, Anuj Choudhary, warned that a rise in crude oil prices could have a negative impact on the rupee.

On the other hand, he thinks that the rupee might be supported at lower levels by the Reserve Bank of India.

Domestic Economic Data Points

On the domestic data front, the foreign exchange reserves for the week ended August 18 will be announced on the same day as the bank loan and deposit growth figures for the week ended August 11.

Technical View

The Nifty50 made lower highs for the fourth week in a row and closed at its lowest level since the last week of June on a weekly basis, but it held above its 50-day EMA (exponential moving average), which corresponds with its 10-week EMA (exponential moving average) on an intraday basis, and above its closing level of 19,300. Therefore, the 19,300-19,250 zone is anticipated to be important for further fall into the psychological 19,000 mark, while the 19,400-19,500 zone is predicted to act as a barrier to the upside.

“Nifty has respected the short term moving average i.e. 50-day EMA twice of late, which currently lies around 19,250 and its break could push the index to 19,100 first, and then to the 18,900 level,” Ajit Mishra, SVP – technical research at Religare Bros., said.

In the event of a reversal, he sees resistance between the 20-day EMA and the 19,650 mark.

F&O Cues

According to the Option data, the range of 19,400-19,500 represents major resistance in the upcoming trading sessions, while the range of 19,300-19,200 represents key support.

Weekly Call open interest peaked at the 19,400 level, followed by the 19,500 level, with significant writing at the 19,400, 19,300, and 19,600 levels, while Put open interest and writing peaked at the 19,300 and 19,200 levels, respectively.

The India VIX rose 5.4% throughout the week, finishing at 12.14 levels, the highest level since the third week of May. This is the third consecutive week that volatility has increased. Additional street caution may be warranted if the VIX rises above the 13.5–14 range , experts said.

Aeroflex Industries, a manufacturer of flexible flow solution products, will open its Rs 351-crore IPO from April 22-24 at a price band of Rs 102-108 per share, and the infrastructure company Vishnu Prakash R Punglia will launch its Rs 309-crore maiden public issue on August 24 at a price band of Rs 94-99 per share, so the primary market will remain active next week as well.

According to the IPO schedule, on August 22 Pyramid Technoplast will complete its Rs 153-crore IPO, and on August 23 TVS Supply Chain Solutions will make its debut on the bourses.

Also Read : Mcap of seven of top 10 firms declines by Rs 80,200 cr; TCS, HDFC Bank biggest laggards

Sungarner Energies, a provider of power solutions, will begin accepting subscriptions for its initial public offering (IPO) on April 21–23 at an offer price of Rs 83 per share; Shoora Designs will end its IPO on August 21; Crop Life Science and Bondada Engineering will both end their IPOs on August 22; and so on. Next week, on August 23, Shelter Pharma shares will be listed on the stock market.

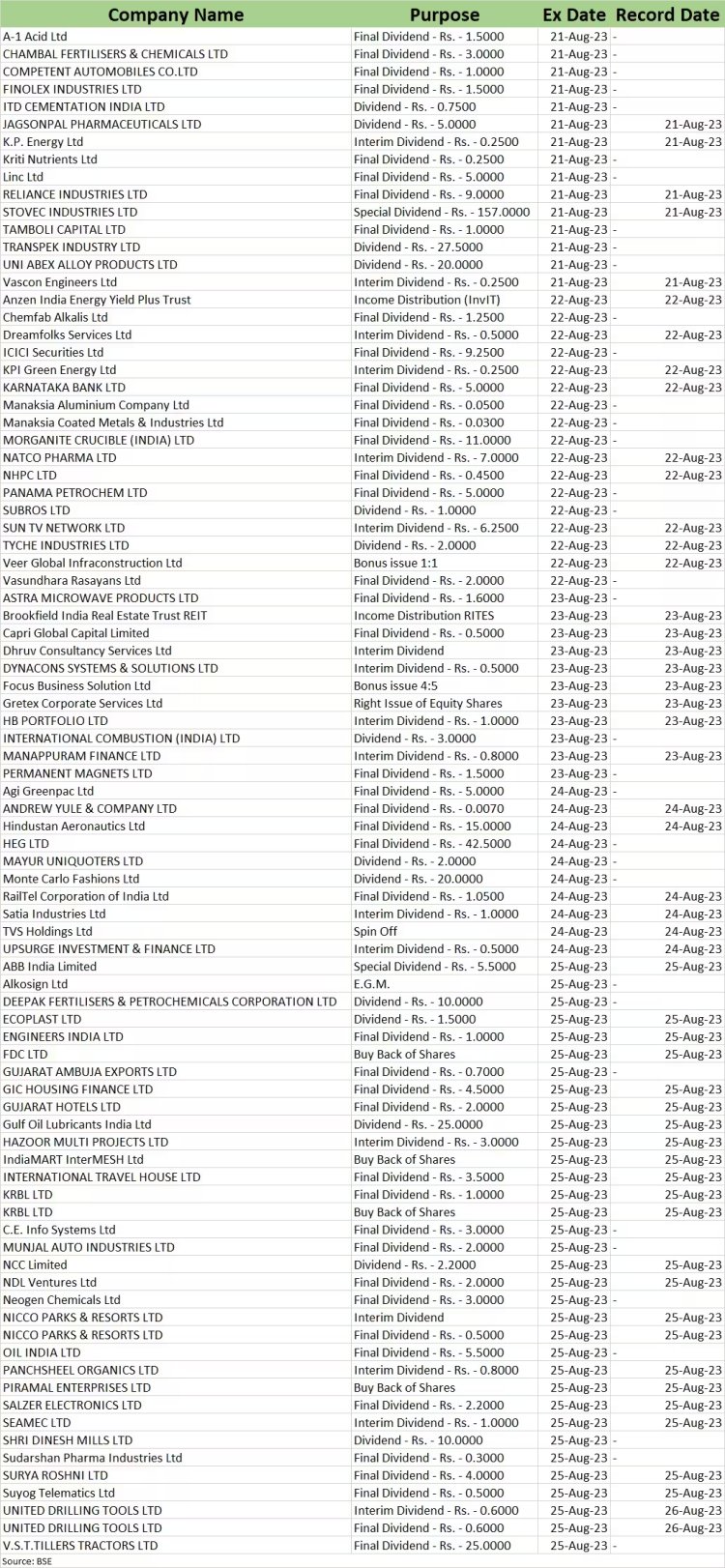

Corporate Action

Here are key corporate actions taking place next week:

Disclaimer: The opinions and recommendations offered by Moneypoise.com’s investing experts are those of the experts themselves and not of the website or its administration. Users of Moneypoise.com are cautioned to only proceed with investing decisions after consulting with licenced professionals.

Note that Moneypoise is a brand of the Network18 family of companies. Reliance Industries is the sole benefactor of Independent Media Trust, the entity that controls Network18.