Financial inclusion is the process of ensuring that everyone has access to affordable financial products and services. This includes access to basic banking services, such as savings accounts, credit, and insurance. Financial inclusion is essential for sustainable economic development, as it allows people to participate in the formal economy, save for the future, and invest in their businesses.

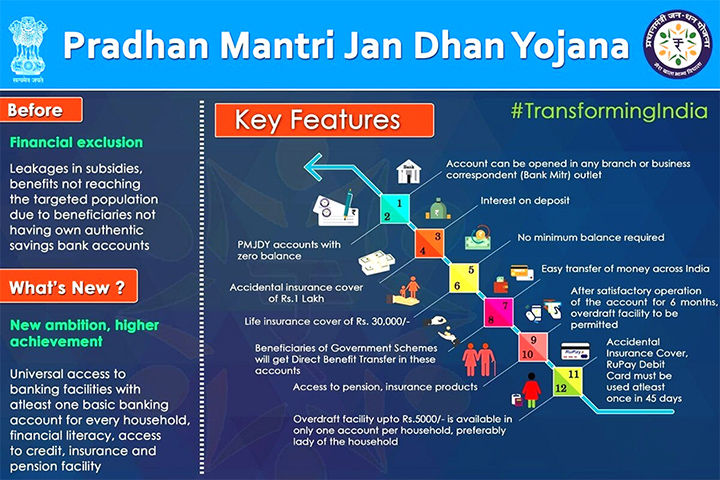

Pradhan Mantri Jan Dhan Yojana (PMJDY) is India’s National Mission on Financial Inclusion. It was launched in 2014 with the objective of providing access to banking services to all Indian citizens. PMJDY is one of the world’s largest financial inclusion programs, and it has achieved significant success in its mission.

Key features of PMJDY:

Universal access: PMJDY is open to all Indian citizens, regardless of their income or social status.

Zero-balance accounts: PMJDY accounts can be opened with a zero balance. This makes it accessible to even the poorest of the poor.

RuPay debit card: All PMJDY account holders are issued a RuPay debit card. This card can be used to withdraw cash, make payments, and access other banking services.

Accident insurance: All PMJDY account holders are covered by an accidental insurance policy of up to ₹1 lakh.

Overdraft facility: Eligible PMJDY account holders can avail of an overdraft facility of up to ₹10,000. This can be used to meet unexpected financial needs.

Achievements and Impact

The Pradhan Mantri Jan Dhan Yojana has achieved remarkable success since its inception, with numerous positive impacts:

Massive Account Opening: Within a short span of time, PMJDY led to the opening of millions of bank accounts, bringing marginalized sections of society, particularly in rural areas, into the formal banking system.

Empowering Women: The scheme has been instrumental in promoting gender equality by encouraging the opening of bank accounts in the name of female family members. This not only empowers women but also enhances their financial independence.

Financial Inclusion: By extending banking services to the previously unbanked, the scheme has contributed significantly to reducing financial exclusion and fostering economic growth.

DBT Efficiency: The scheme’s integration with various government benefit programs has led to the direct transfer of subsidies, reducing intermediaries and leakages, and ensuring that the intended beneficiaries receive the full benefit.

Boost to Small Enterprises: PMJDY has facilitated easier access to credit for small-scale businesses and entrepreneurs, thereby fostering entrepreneurship and boosting local economies.

Challenges and Future Prospects

While the PMJDY has been largely successful, certain challenges remain:

Financial Literacy: Despite efforts to promote financial education, there’s a need for continued emphasis on enhancing the financial literacy of account holders to ensure they understand the benefits and responsibilities of having a bank account.

Active Use of Accounts: Encouraging account holders to actively use their accounts for savings, investments, and transactions is crucial for the long-term success of the scheme.

Cybersecurity and Technology: With the increasing reliance on technology for banking services, ensuring robust cybersecurity and digital literacy among account holders is essential.

Deepening Services: Expanding the range of financial products and services available to PMJDY account holders, such as insurance, pension plans, and investment options, can further improve their financial well-being.

Conclusion

The Pradhan Mantri Jan Dhan Yojana stands as a shining example of a government initiative aimed at transforming the lives of millions by providing them with access to formal banking services. By bringing the unbanked population into the financial mainstream, PMJDY has not only contributed to economic development but has also empowered individuals, especially women, and improved their overall quality of life. As India moves forward, it is imperative to build upon the successes of this scheme and address its challenges to ensure a more financially inclusive and prosperous society.