Ray Dalio, the founder of Bridgewater Associates, is a successful investor and self-made billionaire. He started trading in equities before he was a teenager. He had already built an investing portfolio worth several thousand dollars before entering high school.

Ray Dalio attributes his tremendous success to his investing philosophies and, to a lesser extent, transcendental meditation.

Here are some basic investing principles explained:

Build your own success: Ray Dalio was not a great admirer of school and in fact, he detested it. Therefore, he decided to forge his own path to prosperity.

Mowing lawns, shoveling snow, and delivering newspapers were just a few of the odd chores he took on. At the tender age of twelve, he put $300 into shares of Northeast Airlines and, following a merger, saw his investment grow to $900.

As a result, he learned that if he put in the effort, he could achieve his goals.

Building independent opinions: He used to collect coupons and trade them in for Fortune 500 company annual reports when he was a kid.

After amassing them, he made his own attempt to decipher the market. He evolved an original and distinctive approach to management as a result.

Investing in sectors you know of: He thinks investment is dangerous in general and across all industries.

Selecting industries with which you already have familiarity can help you reduce investment risk.

Avoid being reactive: The direction of the markets is a major consideration for many investors. Investors typically buy when stock prices are high and sell when prices are low.

Since a company whose stock is down may be priced at an appealing valuation, this is plainly not sound advice.

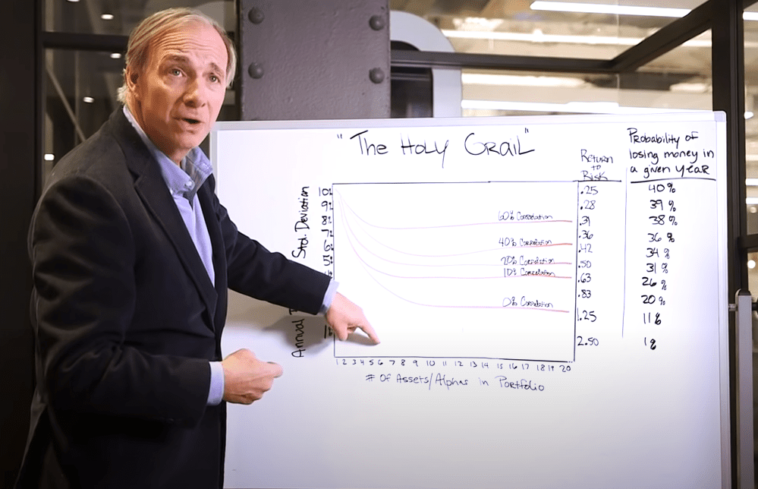

Bringing risk lower: Ray Dalio is well-known for being aware of the dangers that come with investing.

Many people attribute Dalio’s unconventional management style as the primary reason why Bridgewater Associates became the largest fund firm. He takes precautions by spreading his money around in several markets to reduce the likelihood of losing everything if the market goes south.