Hansal Mehta took to Twitter to share his thoughts on Bheed, the March 24 release starring Rajkummar Rao and Bhumi Pednekar. The film, directed by Anubhav Sinha, focuses on the struggles of migrant laborers in India during the COVID-19 lockdown in the year 2020 and compares the situation to the Partition of India in 1947. Hansal praised the film and the cast’s performances, calling it “one of the finest ensembles since Maqbool.”

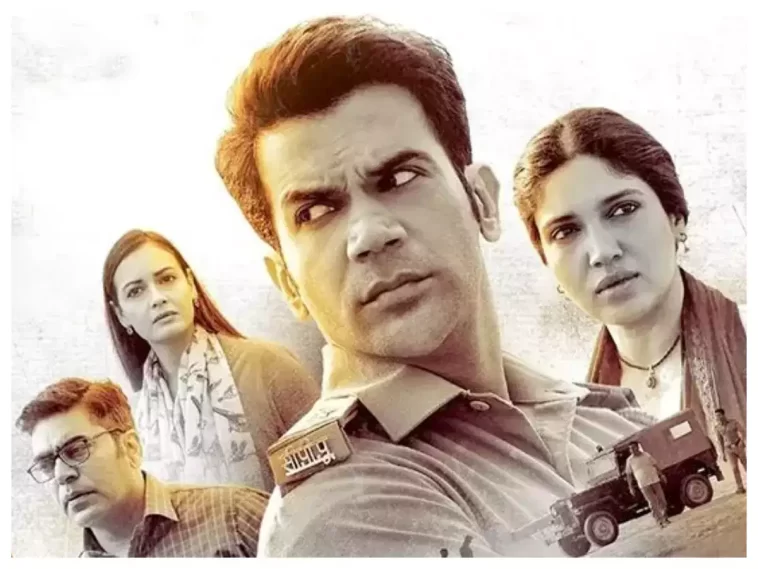

The National Award-winning director shared a brief review of the film on Twitter, along with the film’s poster: “#Bheed in theaters tomorrow. In addition to being a vital historical document, this film features one of the most compelling and dramatic ensembles since Maqbool. Rajkummar Rao’s portrayal of a conflicted “in charge” is exceptional. He is at the pinnacle of his talent.” In the comments, he added, “Pankajji (Pankaj Kapur), Virubhai (Veerendra Saxena), Ashutosh Rana, Aditya Shrivastava, Bhumi, and the complete cast assembled by @CastingChhabra are all outstanding. Aditi Subedi’s story is particularly tragic. Avoid missing #Bheed.”

ALSO READ : “Found Its Audience,” Rani Mukerji said of Mrs. Chatterjee vs. Norway

When the film’s official trailer debuted earlier this month, it garnered significant attention. The trailer was subsequently removed and re-released after Prime Minister Narendra Modi’s speech and a reference to the Partition were removed in response to mixed reactions. During an interview with the news agency PTI, Anubhav stated, “Of course, these alterations are evident. The trailer was off the air for two days, and the alterations noted are accurate. Nonetheless, this is the filmmaker’s business. I would prefer not to disturb the film’s sanctity.

Hansal had also supported the film at the time Sumit Kadel, a film industry analyst, described it as “absolutely ridiculous.” He remarked, “I suppose you’ve seen the movie.” Hansal also wrote in response to a separate tweet, “Let’s hear the political ideology you espouse in your tweet, gentleman. Mine supports unfettered expression and speech. My ideology supports inclusivity and is open to debate and criticism.”

Benaras Mediaworks’s Anubhav produces the film Bheed, which was shot extensively in Lucknow. Bheed also features Dia Mirza, Kritika Kamra, Virendra Saxena, Aditya Srivastava and Karan Pandit.