Wednesday, in anticipation of the impending Char Dham Yatra, Uttarakhand Chief Minister Pushkar Singh Dhami instructed the relevant authorities to make all necessary preparations in a timely manner.

Uttarakhand is preparing for the Char Dham Yatra.

The Chief Minister has requested that the tourism department and police hold a meeting with the district magistrates involved to finalise the necessary preparations. He added that it must be ensured that the sentiments of the businesspeople associated with the route are respected.

According to Chief Minister Dhami, more devotees will visit the state this year during the forthcoming Yatra; accordingly, it is necessary to make preparations in advance. Here are Dhami’s instructions to the authorities pertaining to the Char Dham Yatra.

- By April 15, all travel arrangements should be finalised.

- Along with the enhancement of the Yatra route’s roads, an effective action plan for passenger-friendly arrangements is required.

- To make preparations for the impending Char Dham Yatra in anticipation of a large number of pilgrims.

- The administration should prioritise fostering a favourable environment .

The Uttarakhand Tourism Development Council (UTDC) announced earlier this month that over 2.50 million devotees have registered for the Char Dham Yatra. There have been 1.39 million registrations for Kedarnath Dham. In contrast, 1.14 million registrations have been made for Badrinath Dham.

Kedarnath Dham will open on April 25 and Badrinath Dham will open on April 27. Meanwhile, the Gangotri Temple Committee announced on Wednesday that the temple would welcome devotees beginning on Akshaya Tritiya, April 22. The district administration of Rudraprayag has initiated preparations for the Char Dham Yatra, according to officials.

The district administration has begun removing the snow from the Kedarnath Dham and the Kedarnath footpaths, according to the officials.

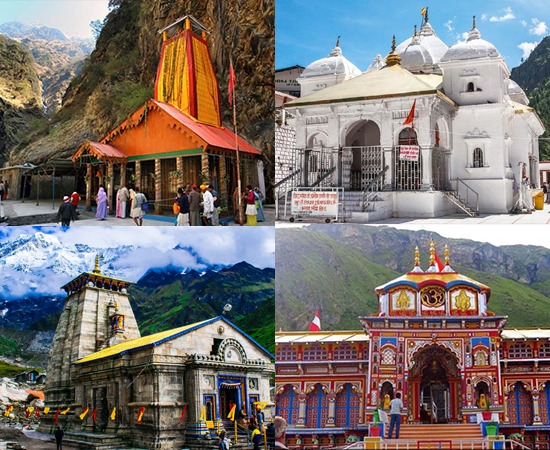

Char Dham Yatra

Uttarakhand is among the most well-known Hindu pilgrimages in India. This pilgrimage is a tour of four holy locations in the Himalayas: Badrinath, Kedarnath, Gangotri, and Yamunotri.The high-altitude sanctuaries are closed for approximately six months per year, opening in the summer (April or May) and closing as winter approaches. (October or November).

Also Read | Padma Awards 2023: Jhunjhunwala,industrialist KM Birla, others honoured

During it, the Char Dham pilgrimage begins at Yamunotri, continues to Gangotri, then continues to Kedarnath, and concludes at Badrinath. The journey can be concluded by road or by helicopter, as both options are available. Some devotees even undertake a Do Dham Yatra, or pilgrimage to the two most well-known shrines, Kedarnath and Badrinath.