According to officials after Sisodia Resignation, the extra responsibilities of finance and electricity have been assigned to Delhi Revenue Minister Kailash Gahlot, and the responsibilities of education and health will be handled by Social Welfare Minister Raaj Kumar Anand until new ministers are nominated to the Cabinet.

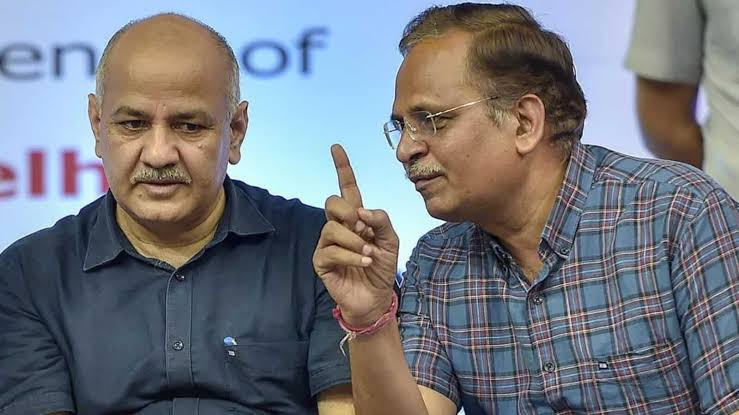

The resignations of Manish Sisodia and Satyendra Jain from the Arvind Kejriwal-led government following their arrests on corruption charges on Tuesday were followed by the announcement.

Officials claim that Kejriwal has accepted the resignations of the two individuals who were instrumental in carrying out his governance plan for improved educational and medical facilities in the nation’s capital.

In the Delhi government, Sisodia oversaw 18 of the 33 ministries. Gahlot and Anand have been given interim custody of his portfolios.

“Until new ministers are named, Gahlot will be responsible for managing the departments of finance, planning, public works, power, home, urban development, irrigation and flood control, and water in addition to his current responsibilities.

In addition to his current portfolios, Raj Kumar Anand will oversee education, land and building, vigilance, services, tourism, art, jobs, health, and industries, according to a government official.

Two new ministers will be appointed “very shortly,” according to AAP national spokesperson Saurabh Bhardwaj, hours after Delhi Chief Minister Arvind Kejriwal accepted the resignations of Sisodia and Jain on Tuesday.

The resignations came minutes after the SC rejected Sisodia’s request for bail while he was being held by the CBI in connection with the now-dismissed excise policy case, stating that doing so would set a “wrong precedent” and that he had access to effective alternative options.

While Jain, who is presently lodged in Tihar, was detained by the Enforcement Directorate in May of last year in connection with a money laundering case, Sisodia was detained by the CBI on Sunday evening after nearly nine hours of questioning.

Also Read | Oscar 2023:At the award ceremony, the song “Naatu Naatu” from “RRR” will be performed.

However, Jain remained to be a minister in the Delhi government without any portfolios. Sisodia received Jain’s portfolios, which included the departments of health, housing, and municipal development.