Introduction

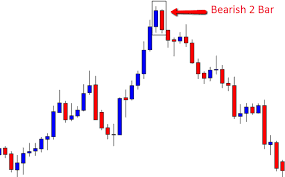

Candlestick patterns are used by technical traders and price action traders to forecast market movement and spot trading opportunities. Intriguing things happen when the indicators are used in conjunction with candlestick patterns and prior knowledge.

A trader’s success on the Financial Market hinges on his or her ability to anticipate price increases and decreases. The two-bar reversal pattern is an essential trading indicator that can be used in conjunction with other technical analyses and tools for identifying and projecting trends in price movement.

What Is The 2 Bar Reversal Pattern?

-Two-bar reversal patterns can be either bullish or negative. First, the market rises, as seen by the first bar in a bearish 2-bar reversal pattern, and then the second bar forms, reversing from the highs of the first bar and moving the price farther lower on the chart. A change in direction can be seen here.

-The price of an asset forms a bullish 2-bar reversal pattern when it first falls below the low of the prior trading day and then rises above the high of the prior trading day’s closing price.

-Assume there is a prolonged upward trend; if this pattern appears on the chart, it indicates that the markets are making reversals and going on the opposite side significantly.

What Are The Characteristics Of The Best 2 Bar Patterns?

There are numerous 2 bar patterns, but not all of them should be traded. If you wish to trade the finest 2 bar patterns, you must understand their characteristics. The characteristics of the finest 2 bar patterns are listed below.

The bars will exhibit considerable overlap.

There will be a significant drive towards two bar formations.

The finest patterns will always be distinguishable from the background noise. Typically, they occur at the conclusion of trends.

How To Trade This Pattern?

There are two strategies to trade this reversal pattern, both with pros and cons depending on your risk tolerance and trading style.

- For Traders with High Risk-Appetite – Enter the market as soon as the price breaks out of the first bar. The idea is to catch the momentum of potential trend reversal early. The approach is aggressive as the trader enters the market even before the pattern fully forms.

- For Risk-Averse Traders – Breakouts are the optimal entry point for trades based on this pattern. Wait for the second bar to break above the highs of the first bar in a bullish reversal pattern. If you’re looking for a bearish signal, hold off until the second bar breaks down through the lows of the prior candlesticks.

After learning the reversal patterns, you’ll be well-equipped to capitalise on market turnarounds. Stop wasting time; sign up for a trading account with us and get started immediately.

Also Read : Accumulate Hero Motocorp; target of Rs 3535: Prabhudas Lilladher