Introduction

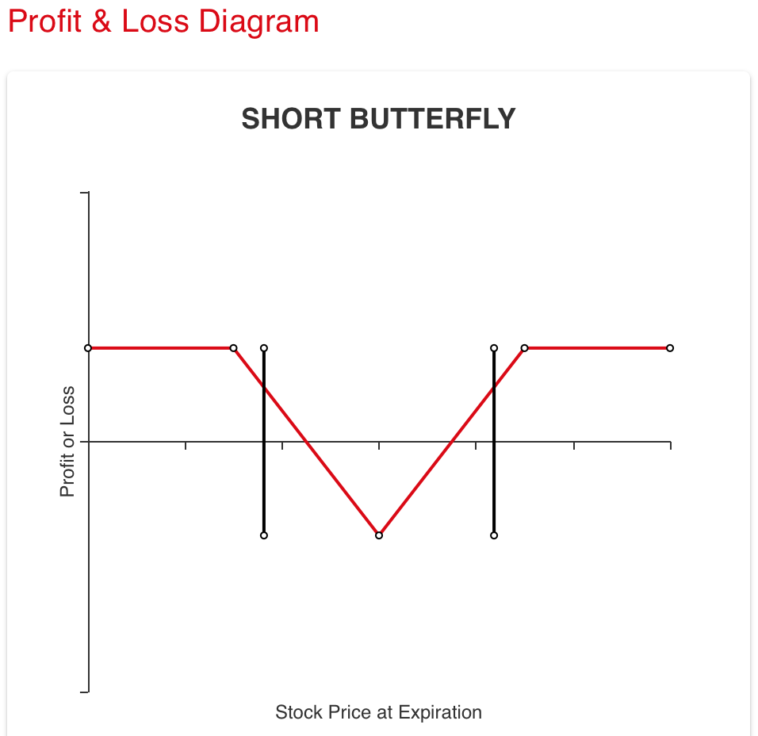

The short-put butterfly approach does not take any particular market into account. It can be used to profit on a stock’s rise or decrease in price if it trades above or below the high and low strike prices, respectively. Three puts with equally spaced strike prices and the same expiration date make up the strategy.

What is a short-put butterfly strategy?

The short-put butterfly is a trading strategy with three legs. It involves selling an OTM put option, purchasing two ATM put options, and selling an ITM put option. It is a combination of bull put spreads and bear put spreads.

The strategy seeks to be agnostic regarding market direction. However, it benefits from the possibility of increased volatility. Moreover, the positions’ risk and reward are predetermined and limited.

The butterfly option spread is a net credit strategy. With a neutral trajectory, there are two points of breakeven. To determine the upper breakeven point, deduct the net premium received from the upper strike price. To determine the lower breakeven point, add the net premium to the lower strike price.

Due to two breakeven thresholds, the strategy provides two profit opportunities. When the price of the underlying stock exceeds either of the breakeven points, you can realize maximal profit. Such price fluctuations are caused by an increase in volatility and rapid price fluctuations. However, as the strategy has a limited risk-to-reward ratio, profits are limited to the option premium received. The profit equals the net amount of premium received.

In contrast, when volatility declines and there is no change in price or you are between the two breakeven points, you must calculate the utmost potential loss, which is limited.

The formula for calculating loss is as follows:

Lower strike – middle strike + net premium received

When initiating this strategy, it is essential to ensure that the strike prices are evenly spaced. This indicates that the price difference between the lower and intermediate strike and the middle and higher strike is identical.

Illustration

Here’s a look at the three put options you will make to initiate the short-put butterfly options strategy.

- Short 1 ABC 110 at 200

- Long 2 ABC 100 at 175

- Short 3 ABC 90 at 175

Total premium paid = 175*2 = 350 (since you will be buying two units in the second step)

Total premium received = 200 + 175 = 375

Net premium received = 375 – 350 = 25

Initiating the strategy returns a net credit of Rs. 25 in this example.

The strategy seeks to profit from an increase in implied volatility or asset price movement. Due to the resemblance to a butterfly, this strategy is referred to as the short-put butterfly option strategy.

HP Laptop 15s, 11th Gen Intel Core i3-1115G4, 15.6-inch (39.6 cm), FHD, 8GB DDR4, 512GB SSD

Xiaomi [Smartchoice] Notebookpro Qhd+ Ips Antiglare Display Intel Core I5-11300H 11Th Gen

When can you initiate the short-put butterfly strategy?

A short-put butterfly’s objective is to profit from rapid price changes in underlying assets. With rapid price fluctuations, volatility increases. A rise in volatility causes an increase in option prices, whereas a decline in volatility indicates a decrease in option prices.

The strategy can be initiated when the volatility of the underlying asset prices is minimal. However, it requires perseverance and self-control. You must wait for stock prices to increase or fluctuate. When the expiration date is close, a minor change in the price of the underlying stock can have a significant impact on the price of the options. Therefore, you must be disciplined in recording minor losses and partial profits prior to achieving success.

Pros of the short-put butterfly

- The strategy determines the utmost loss possible.

- The credit strategy incurs no capital outflow upon inception.

- It benefits from time decay and volatility increase.

Cons of the short-put butterfly

- Earnings potential is low.

- When the underlying price is stuck in a narrow band, the combined effects of theta and time decay have a deleterious effect on the position.

- The potential for loss is greater than the potential gain, hence the strategy has a poor risk-to-reward ratio.

Also read:-How to Pay Your Bills When You Lose Your Job

Conclusion

The short-put butterfly options spread is an effective net credit technique that does not require an upfront financial outlay. When volatility and decay in value increase, it does well. The strategy’s success depends on your timing of its implementation. It takes less time for implied volatility to show effects if you start it closer to expiration to take advantage of swift time decay.

It’s possible that the strategy’s poor risk-to-reward ratio is discouraging you from pursuing it. The payout is comparable to that of the Long Call Butterfly and the Long Iron Butterfly option strategies, though.