Some investment managers are becoming more cautious as they see mounting indicators of consumer stress, even while the overall stock market continues to rise.

Despite continued low unemployment, families are feeling the pinch of the Federal Reserve’s interest rate increases to combat inflation.

As reported by the Apollo Group, consumer confidence plummeted faster than anticipated in August, and default rates for credit cards provided by smaller banks reached an all-time high.

Debit card defaults at Nordstrom have increased to post-pandemic levels, the retailer reported last week. Credit card sales will be down 41% from the previous quarter, according to Macy’s chief rival, who blames late payments.

In October, borrowers will once again be responsible for making payments on around $1.1 trillion in federal student loans, which, according to a research by TransUnion, may cause monthly “payment shock” of $500 or more for certain borrowers.

According to Emily Roland, co-chief investment strategist at John Hancock Investment Management, “the U.S. consumer is on thin ice coming into the final stretch of 2023.” She has a greater optimism toward bonds and defensive sectors like healthcare as we approach the Christmas shopping season in the fourth quarter.

A total of 187,000 non-farm jobs were added to the US economy in August, which was slightly over estimates, but the unemployment rate increased to 3.8% as of September 1st, according to the Bureau of Labor Statistics. Previous projections for employment growth in June and July were drastically reduced by the government.

Investors will undoubtedly feel the effects of a double-edged sword as the job market continues to deteriorate, with some inflation pressures alleviated but consumer spending restrained.

The Commerce Department said on August 31 that consumer spending increased somewhat more than predicted in August, while the savings rate dropped to its lowest level since November 2022.

According to Jake Jolly, senior investment strategist at BNY Mellon Investment Management, who is underweight equities and anticipates the U.S. economy to be headed into a recession, consumers will “very soon” drain their extra reserves built up during the pandemic.

“It does beg the question of how long consumer spending can surprise to the upside,” he said, adding that bonds continue to look more tempting despite a surge in yields that has brought the 10-year Treasury yield above 4 percent.

According to Gregory Daco, chief economist at accounting firm Ernst & Young, consumer spending growth would slow from 2.3% in 2023 to 0.9% in 2024 as a result of increased interest rates, fewer available savings, and student loan payments. He predicted below-trend economic growth for a number of quarters.

Two-thirds of the economy is made up of the services sector, and next week investors will get a new look at consumer credit consumption as well as a reading of the ISM services sector.

To wager against consumer spending has proven fruitless thus far. The GDPNow tool from the Atlanta Fed predicts continued expansion in the US economy in the third quarter, with an annualized pace of 5.9 percent.

According to Jason Draho, head of asset allocation Americas at UBS Global Wealth Management, investors should buy into any falls in consumer equities as interest rates are expected to fall in the fourth quarter of this year and into 2024 as inflation fears ebb, giving some cushion for consumers.

He predicted that “the US consumer and, by extension, the economy,” would continue to show strength until 2024.

Stocks in the consumer discretionary sector, which includes companies like Amazon.com, Royal Caribbean Cruises, and Chipotle Mexican Grill, are up about 34% year to date, nearly doubling the gain of the S&P 500 index.

The S&P 500 index has increased by approximately 2 percent since July 1, whereas this industry has gained less than 1 percent.

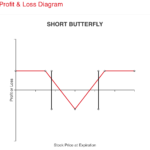

Also read:- Short Put Butterfly Option Strategy Explained

Sandy Villere, portfolio manager at Villere & Co., predicts that even if consumer spending drops significantly, the robust gain in the sector would likely diminish as the tech-driven broader market slows throughout the fourth quarter.

Villere is hedging his bets by increasing his holdings in industries like healthcare that have not shown signs of weakness.

As the Fed’s rate hikes take effect in the first quarter, he predicts a recession will begin in the first three months of the year.