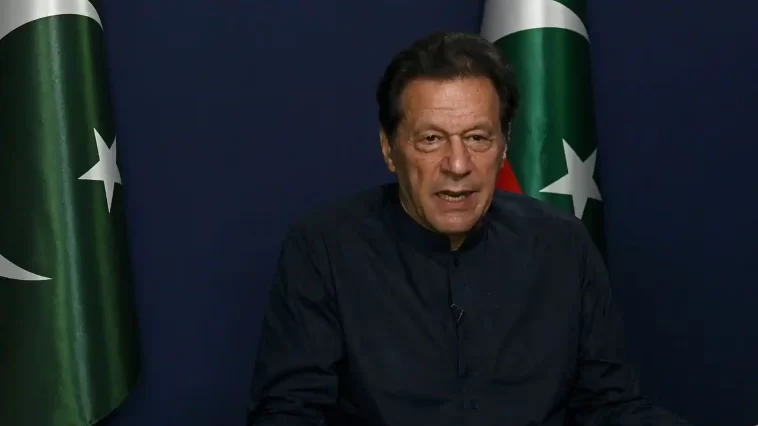

Pakistan is contemplating banning Pakistan Tehreek-e-Insaf (PTI), the political party of former Prime Minister Imran Khan, Defense Minister Khawaja Asif said on Wednesday.

The action comes in the midst of political instability in the nuclear-armed nation caused by Imran Khan’s arrest on corruption charges on May 9 and subsequent release on bail by court order.

Imran Khan, who claims that corruption charges are fabricated, is embroiled in a conflict with Pakistan’s powerful military, which has either governed Pakistan directly or oversaw civilian governments throughout its history.

ALSO READ :Imran Khan asks Musarrat Cheema to approach SC in new audio leak.

Asif informed reporters that a ban on the PTI was being considered. “The PTI has assaulted the very foundation of the state, which has never occurred before. It cannot be accepted”.

The arrest of Imran Khan prompted violent protests across the nation, with army establishments attacked and state buildings set ablaze.