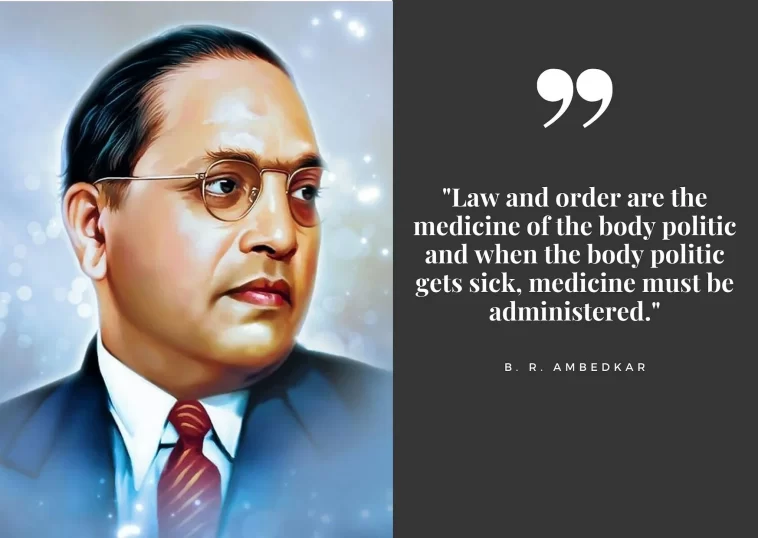

President Droupadi Murmu greets indian’s citizen on the occasion of the 132nd Jayanti of Babasaheb Bhimrao Ambedkar, a Dalit icon and the father of the Constitution.

Murmu posted on Twitter, “On the occasion of Jayanti of our Constitution’s architect, Babasaheb Bhimrao Ramji Ambedkar, I extend my warmest greetings and best wishes to all my fellow citizens.”

President Droupadi Murmu paid floral tributes to Babasaheb Dr B.R. Ambedkar on his birth anniversary at Parliament House Lawns, New Delhi. pic.twitter.com/p43jRj47Gj

— President of India (@rashtrapatibhvn) April 14, 2023

“As an educationist, legal expert, economist, politician, and social reformer, Dr. Ambedkar labored tirelessly for the welfare of the nation, despite facing adversity. He was a symbol of knowledge and genius. “His fundamental tenets – Educate, Organize, and Struggle to Bring the Disadvantaged into the Mainstream of Society – will always be relevant,” she said.

She went on to say that Ambedkar’s unwavering belief in the rule of law and dedication to social and economic equality are the foundation of India’s democracy.

“On this occasion, let us make a commitment to adopt the ideals and life values of Dr. Ambedkar and to continue our efforts to build an egalitarian and prosperous nation and society,” she added.

Also read this:The entourage of the Ukrainian president embezzled USD 400 million from fuel purchases aid

Ambedkar was an Indian jurist, economist, politician, and social reformer who fought against social discrimination and advocated for the rights of women and laborers. He was born on April 14, 1891. He died on December 6, 1956.

Ambedkar was awarded the Bharat Ratna, India’s highest civilian honor, in 1990.