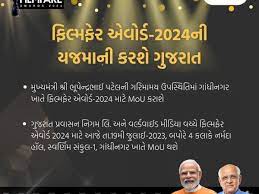

The 69th edition of the Filmfare Awards, one of India’s most prestigious film awards, is host to the state of Gujarat.

Filmfare and Government of Gujarat signed a Memorandum of Understanding (MoU) on Wednesday for the 69th Filmfare Awards to be held in Gujarat in 2024.

Chief Minister of Gujarat Bhupendrabhai Patel and Managing Director of Times Group Vineet Jain presided over the signing ceremony.

Tiger Shroff, a Bollywood actor, will also be present as a prominent guest. The event’s guest of honour will be Mulubhaha Bera, Gujarat’s Minister of Forest and Environment.

In 2024, the Filmfare Awards will make a diversion to Gujarat from their usual location in Mumbai.

Also read this:misuse of IAS officers to “serve” opposition leaders: HD Kumaraswamy

Cabinet Minister Rushikesh Patel announced on Twitter that Gujarat, a vibrant state, will host the prestigious Filmfare Awards in 2024.