In August 2023, India’s Unified Payments Interface (UPI) achieved the incredible achievement of 10 billion transactions. Despite considerable expansion, the rural-urban divide continues in the digital payment environment. The regional experiences during the Covid-19 pandemic highlight the necessity of female banking correspondents in reducing the gap and further unlocking India’s digital payments potential.

BANK SAKHIS ENABLING DIGITAL PAYMENTS ADOPTION IN RURAL INDIA

The female banking or business correspondent (BC) concept, introduced in 2015-16 by the National Rural Livelihood Mission (NRLM) and sponsored by the World Bank, has quickly acquired traction in rural India. This concept, known as the ‘Bank Sakhi’ model, is a gender-focused modification of traditional rural banking practices. Members of self-help groups, often women, provide financial services in places where there are no actual bank branches.

The reasoning for employing women as BCs was sound, given that women make up more than half of Pradhan Mantri Jan Dhan Yojana (PMJDY) account holders in rural and semi-urban areas. Despite this, the majority of BC agents were men. To address this disparity, the Bank Sakhi Program was established to assist first-time female customers in navigating the sometimes difficult banking market.

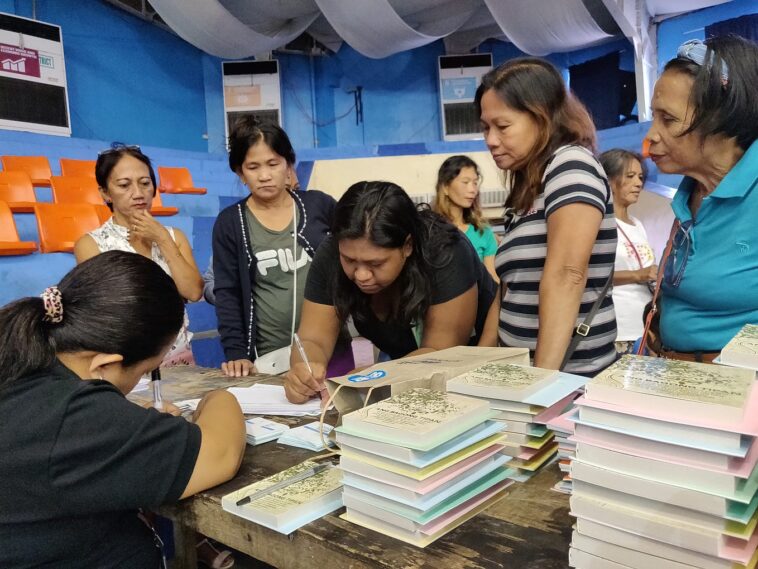

Over 100,000 women have been trained to work as mediators for public and commercial banks in 20 states since the program’s inception. These ladies perform secure digital transactions on behalf of their customers using cutting-edge technology and instruments such as Micro-ATM machines and smartphones. These Bank Sakhis, in addition to providing traditional financial services, educate their customers on the benefits of digital payments, provide training on the capabilities of digital payment platforms, and handle their concerns in the event of transaction failures.

THE EXPERIENCES OF BIHAR AND ODISHA

Bank Sakhis’ success has been especially noteworthy in low-income regions such as Bihar, Odisha, and Madhya Pradesh. Recent research by the Asia Competitiveness Institute underscores the critical role played by Bank Sakhis in developing these states’ digital payment capabilities. Despite their low digital competitiveness, these nations jumped ahead in digital transactions after the epidemic, owing mostly to the success of the Bank Sakhi program. According to data from a private sector bank in Bihar, 33 out of every 40 Bank Sakhis conducted at least one transaction daily between March and July 2020. Meanwhile, in Odisha, 90 of 126 Bank Sakhis of a public sector bank made at least one transaction per day.

PIVOTAL IN THE DIGITAL TRANSFER OF COVID-19 RELIEF PACKAGES

During the pandemic-induced lockdowns, SHG members operating as Bank Sakhis took the lead in promoting awareness and allowing doorstep access to cash transfers through the Pradhan Mantri Garib Kalyan Yojana (PMGKY) and other Direct Benefit Transfer initiatives. More than 200 million women account holders under the PMJDY were able to collect Rs 1500 apiece over the course of three months as a result of this effort.

The Indian government chose digital transfers to channel cash to PMJDY accounts as a deliberate move to reduce leakages inside the Direct Benefit Transfer scheme. Recognizing the importance of BC agents’ services in increasing awareness and adoption of these digital transfers, particularly during lockdowns, Bank Sakhis were provided special identification cards known as Lockdown Passes to ensure uninterrupted banking operations.

ROADBLOCKS FACING THE EXPANSION OF THE BANK SAKHI NETWORK

Although the number of female BCs has increased in India, their percentage is still dismal, accounting for less than 10% of the overall BC network as of April 2022. The NRLM-introduced ‘One Gram Panchayat One BC Sakhi’ program intends to alleviate this inequality by assuring the deployment of at least one Bank Sakhi in each Gram Panchayat by the end of the 2023-24 timeframe.

Several factors contribute to Bank Sakhis’ low representation. Bank Sakhis have mobility issues as well as safety problems. These women face higher transportation costs and safety issues than their male BC counterparts since they are frequently dependant on male family members for things such as visiting bank branches for cash deposits or withdrawals. Bank Sakhis receives no formal financial assistance to rectify such issues.

Bank Sakhis face tremendous time constraints as a result of cultural expectations that they fulfill domestic chores in addition to being a BC, resulting in efficiency losses. Male agents execute twice as many transactions as Bank Sakhi representatives, while working an extra 3-4 hours per day.

Another barrier to recruiting Bank Sakhis, particularly in neglected rural areas, is the minimal certification requirement. The current RBI criterion is a minimum of a tenth pass. However, numerous banks have raised the eligibility hurdle to the 12th pass, potentially making it difficult to attract talent to serve as BCs in isolated rural areas.

WAY FORWARD

Moving forward, various viable options to addressing Bank Sakhis’ difficulties could be pursued. These include providing liquidity support, boosting social security payments, and ensuring risk coverage for individual travels to and from the bank. Banks could also raise the limit on working capital loans made to BCs. Most critically, banks must mitigate technical issues on the backend. Bank Sakhis must have a stable financial infrastructure in order to provide a smooth banking experience in rural areas.

During the recent launch of the ‘Samarth Campaign’ to promote digital transactions in 50,000 gram panchayats, Minister for Rural Development and Panchayati Raj Giriraj Singh recognized the critical role performed by Bank Sakhis in encouraging digital transactions. Given the benefits of the female BC model, Bank Sakhis are critical in advancing India’s digital financial inclusion.