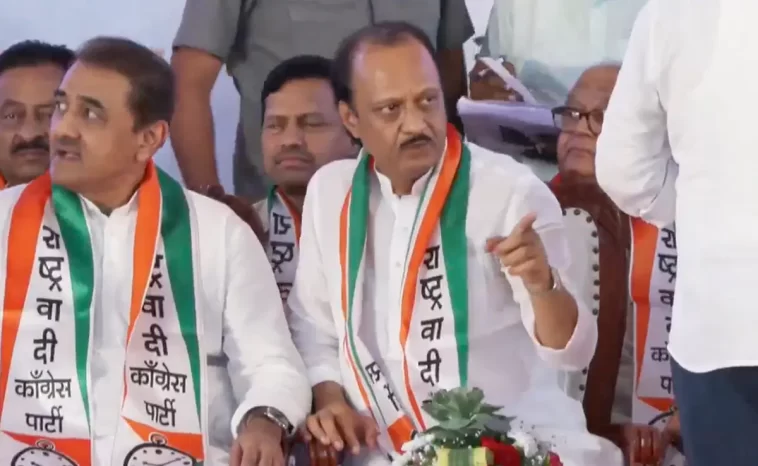

Ajit Pawar, the deputy chief minister of Maharashtra, has moves the Election Commission of India (ECI) for the use of the name and symbol of the Nationalist Congress Party (NCP) following a 1999 schism in the party founded by his father, Sharad Pawar.

“On the same day as receiving the petition, ECI also received affidavits from forty Members of Parliament, Members of Legislative Assembly, and Members of Legislative Council. The commission received these documents officially on July 5, 2023, a person said on condition of anonymity.

Additionally, ECI has received a resolution enacted by his faction that elects Ajit Pawar as president of the NCP.

According to the source cited above, the commission also received a disclaimer from Jayant R. Patil, president of Sharad Pawar’s Maharashtra NCP unit. “In a letter dated July 3, 2023, Jayant R. Patil informed the commission that a disqualification proceeding has been initiated against nine members of the Maharashtra Legislative Assembly. The proceeding has been submitted with the appropriate authority,” the individual added.

Wednesday, HT reported that NCP factions have informed the Election Commission of the party’s division via letter.

Also read this:Who Is Bareilly SDM Jyoti Maurya? UP Officer Accused Of Corruption, Cheating On Husband After Getting Success

Ajit Pawar and eight other NCP legislators joined the Bharatiya Janata Party (BJP) and swore in as ministers in the Maharashtra administration on Sunday. Sharad Pawar, the patriarch of the NCP, and his son, Ajit Pawar, have since sanctioned a series of reciprocal disqualifications and appointments.